Overcoming the challenges facing the finance industry in 2023

5 minute read

Whether it’s new regulatory requirements or emerging fintech challengers, the financial services industry is used to adapting. While banks operated with minimal disruption during lockdowns, global economic fluctuations and rapid technological innovations mean more challenges are on the way. In this article, we share some financial services insights that will help you and your L&D team get ahead.

Data overview

From local branches to head offices, we wanted to find out what’s really happening in the financial services industry. We’ve talked to the teams producing finance learning experiences, and the employees who complete this training. Surveying over 25 L&D professionals and more than 800 learners has revealed some key challenges and opportunities for the financial sector.

Find out more about this research in our Training Trends Report 2022.

Biggest challenges facing finance

Banks constantly need to evaluate and improve their operations to keep up with changes in the industry. If they’re going to succeed in 2023, there are three key challenges to overcome.

-

New and changing regulations

Ever-changing regulations and industry standards mean banks need to make sure their people and systems can keep up.

According to KPMG, financial service firms will face many regulatory challenges in the coming year. These will impact every area of business – from ethical conduct and sustainability to new cloud-based platforms and crypto and digital assets. Differences in state, federal, and global regulations add another level of complexity to staying compliant.

-

Shifting customer expectations

When the pandemic hit, customers had no option but to use digital channels for their banking. Accenture Global Financial Services’ latest consumer study shows that this approach has taken hold. 50% of customers now interact with their bank through apps or websites at least once a week.

Without the human touch, customer trust and brand loyalty have decreased. But expectations remain high. Whether digital or in-person, customers want banking experiences that offer personalized advice.

-

Emerging technology skill gaps

While financial firms have embraced technology, keeping up with innovation requires investment. Whether it’s Artificial Intelligence (AI) digital customer support or virtual reality simulations, a Protiviti report highlights that this change is just as much about people as tech. The adoption of digital technologies requires new skills that are in short supply and require significant efforts to upskill or reskill employees.

Learn more on how to respond to emerging skills gaps in this podcast episode.

What does that mean for finance learning teams?

L&D continues to be critical to responding to changing standards and new skill gaps in the financial services industry. Demand for effective digital learning is high. It needs to be easily updated so when regulations inevitably change, organizations stay compliant.

The pressure is on to move quickly and get it right or risk serious fines. But strict governance involving lots of stakeholders and SMEs can be laborious and slow down learning production. It’s no wonder over 80% of the L&D leaders we surveyed were struggling to:

- Respond at speed

- Manage stakeholders

- Maintain quality

And the challenge doesn’t end once digital learning is produced. 40% of leaders highlighted a lack of investment or budget. L&D teams need to demonstrate their value with improved compliance and better customer experiences.

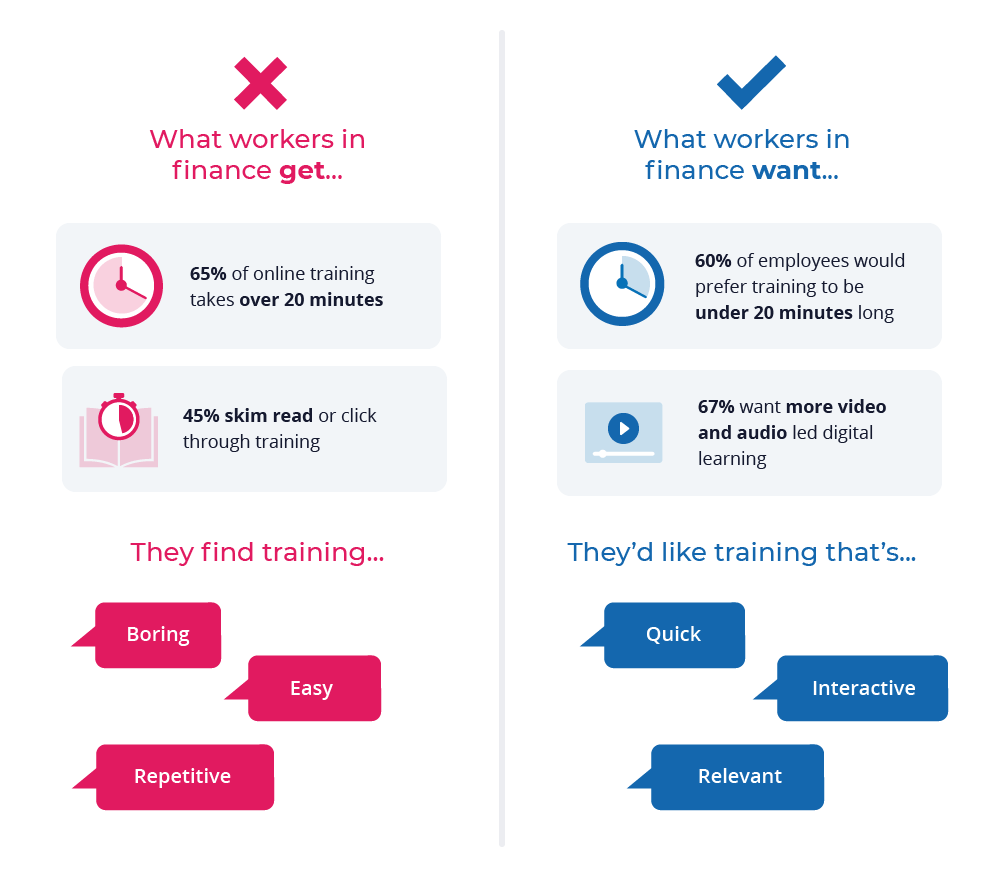

What is the modern learner in the financial services industry looking for?

With a big focus on compliance, just under 90% of financial service organizations deliver most of their training online. So, what do their employees think about all this digital learning?

Want to find out what learners across all sectors want from digital learning? Check out our hand secrets of corporate success infographic.

What can finance learning teams do to get ahead?

The first step is finding out what your employees want and need. Next, it’s time to turn your insights into effective learning experiences. We’ve identified three digital learning trends that will help you deliver business impact and compliance.

-

Create impact with flexible blended learning

30% of businesses are focusing on new hybrid L&D methods. This modern approach to blended learning combines face-to-face and online learning alternatives, like Virtual Instructor-Led Training (VILT), webinars, and elearning. Offering a structure and shape to flexible self-guided learning journeys makes sure you have a real impact.

Want to find out more? Explore our new blended learning strategies.

-

Embrace data-driven personalization

AI isn’t just transforming customer banking experiences. 15% of L&D teams are exploring how it can help them personalize learning. With your employees busier than ever, this is about providing the right learning content at the right time. If you don’t have access to AI technology, use the tools you have to gather data. Once you’ve found out what works, you can create personalized learning that drives impact and efficiency.

See an example of how to deliver personalized scenarios that stick here.

-

Harness the power of video

Want to avoid your people clicking through compliance elearning? Employees at financial services organizations are calling out for more engaging learning experiences. And 41% of learning leaders are responding with a new focus on video. Whether it’s sharing knowledge or telling stories, user-generated videos are a quick and easy way to get content out there. They give voice to your employees’ real experiences and encourage peer learning.

Explore what other elearning trends are emerging this year in the full corporate elearning trends article.

Summary

Banks are constantly evaluating and improving their operations to keep up with changing industry regulations, customer expectations, and technology. You can stay ahead by taking a people-centered approach to your elearning production.

- Find out what your employees really want and need

- Drive impact and compliance with flexible blended learning journeys

- Embrace data-driven personalization to ensure learning is really relevant

- Provide the video learning employees want with user-generated content

By putting your people at the center of L&D you can produce effective digital learning at speed and scale and overcome the finance industry’s key challenges.

If you want to find out more about the latest trends, read our full Training Trends Report 2022.